Minimum Wage debates (2016 to July 2021)

Overview

A summary of States Assembly debates and decisions on the minimum wage for the period 2016 to July 2021.

The Minimum Wage

Jersey has a minimum wage – this is an hourly rate of pay that applies to all employees over school leaving age, with a lower rate set for trainees.

This rate is set by law and employers must pay employees at least at this rate.

The minimum wage has been a frequently debated topic over the last few years, and is set in accordance with the terms of the Employment (Jersey) Law 2003 (the “Employment Law”). It has become the custom for the minimum wage rate to be reviewed once a year and a new rate set, usually in April.

The Employment Law sets out specific actions that are required prior to the States making Regulations, or the Minister making an Order, that are necessary for a change to be made to the minimum wage.

Prior to the approval of a new minimum wage, the Minister must refer the matter to the Employment Forum for its consideration. The Employment Forum considers –

(a) what single hourly rate should be prescribed under Article 16(3) of the Law as the minimum wage;

(b) what period the rate should be applied for (as prescribed under Article 16(4));

(c) what method or methods should be used for determining under Article 17 the hourly rate at which a person is to be regarded as remunerated for the purposes of this Law.

Where matters are referred to the Employment Forum, the Forum considers them and makes a report to the Minister containing the Forum's recommendations.

Further to Article 18(4) of the Employment Law, the Minister has no obligation to take into account the Forum's recommendations when making the relevant Order to set a new Minimum wage.

Minimum Wage vs. Living Wage

The minimum wage is an amount set by law, whereas the living wage is determined by average costs required to maintain a decent standard of living.

There exists two approaches to wage standards.

One, the Living Wage, is designed to achieve a decent standard of living, and the other, the Minimum Wage, is there to prevent exploitation of employees through the payment of substandard wages on which employees cannot live.

Application of the living wage is voluntary; the minimum wage is statutory. Both are backed up by Income Support.

• The minimum wage is determined by the Minister for Social Security, further to consultancy with the Employment Forum (as detailed above).

• The living wage for Jersey is determined by Caritas Jersey and is an hourly rate calculated to cover the basic essentials of living, like housing, food and transport.

Minimum Wage Propositions

Minimum Wage: revised hourly rate from 1st April 2016 (P.150/2015)

Senator Mézec

Debate date: 20th January 2016

Part (a) of P.150/2015 proposed a revised hourly rate from 1st April 2016 of £7.20 in place of the lower rate of £6.97 agreed within the Employment (Minimum Wage) (Amendment No. 9) (Jersey) Order 2015. The report referenced the UK implementation of the £7.20 hourly rate.

Comments from the Council of Ministers noted that this increase would disregard the statutory consultation that had taken place with the Employment Forum and would not meet the 6-month notice period expected by businesses. Part (a) was rejected by the States Assembly

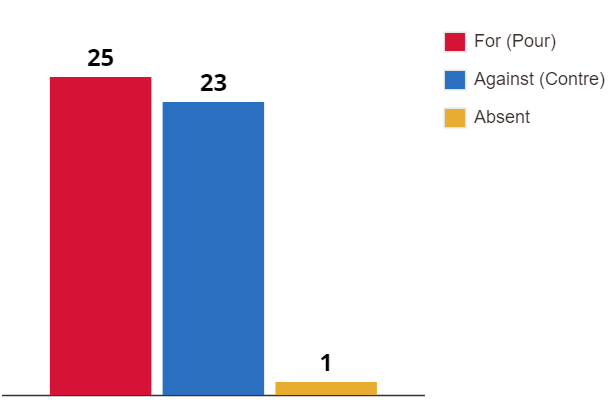

However Part (b) of P.150/2015 was narrowly adopted (see below chart) – despite a lack of agreement from the Council of Ministers (as reflected in its comments).

Part (b) called for an investigation into the tax and benefits system of a significant rise in the minimum wage – and an assessment of the potential impact of an introduction of a 'National Living Wage' scheme, similar to that introduced in the UK.

The agreed report was undertaken by Oxera, published in June 2017, and entitled Raising the minimum wage: economic and fiscal impacts.

Draft Employment (Amendment No.10) (Jersey) Law 201- Amendment (P.38/2016 Amd)

Senator Mézec

Debate Date: 25th May 2016

Senator Mézec's amendment to the Minister for Social Security's Draft Employment (Amendment No. 10) (Jersey) Law 201- proposed to remove from the draft Law all clauses that would enable the States Assembly to set a lower wage for people based upon their age. The attendant report referenced the Discrimination (Age) (Jersey) Regulations, and the amendment was adopted in May 2016.

Minimum Wage: revised hourly rate from 1st April 2017 (P.115/2016)

Senator Mézec

Debate date: 30th November 2016

P.115/2016 requested the Minister for Social Security to revoke the Employment (Minimum Wage) (Amendment No. 10) (Jersey) Order 2016, scheduled to come into force on 1st April 2017, and to take such steps as were necessary to make a new Order fixing the minimum wage at £7.20 per hour from 1st April 2017.

The accompanying report cited the UK National Living Wage of £7.20 and the increase in the Guernsey minimum wage to £7.20 on 1st January 2017. The Minister for Social Security did not support the proposition, referring back to the recommendations of the Employment Forum and noting that the increase to 1st April 2017 was the largest percentage increase in 8 years.

The proposition was rejected, 26 votes to 15.

Draft Employment (Minimum Wage) (Amendment No. 13) (Jersey) Regulations 201- (P.107/2016)

Minister for Social Security

Debate Date: 30th November 2016

This proposition tabled the Draft Employment (Minimum Wage) (Amendment No. 13) (Jersey) Regulations 201-, representing the results of the Employment Forum's review of the Minimum Wage. P.107/2016 was adopted and the minimum wage was set at £7.18 from 1st April 2017.

Minimum Wage: Revocation of Social Security Order (R&O.109/2017) and Amendment of States Act dated 21st April 2010 (P.109/2017)

Senator Mézec

Debate Date: 30th November 2017

P.109/2017 requested Members to –

(a) revoke the latest minimum wage order and instead fix the minimum wage at £7.88 per hour from 1st April 2018; and

(b) to amend the 2010 Order relating to setting the minimum wage as a percentage of average earnings.

Part (a) replicated the terms of P.115/2016 (see above). The Senator referenced the Oxera Report and its findings, in particular, the Oxera Summary of fiscal impacts;

Both the Minister for Social Security and the Council of Ministers provided comments upon this proposition, with the Minister referencing the Employment Forum's comments upon the Oxera Report –

The Forum recognises that both positive and negative estimates can be drawn from the Oxera report. While 14,800 employees would potentially benefit from higher wages, the impact is far greater on those who lose their jobs or face reduced terms and conditions of employment. The report sets out the direct and indirect effects that might come from a 10 percent or 17 percent minimum wage increase and notes that these are likely to result in lower economic activity overall, which is contrary to the policy of the States Assembly to drive economic growth

Part (a) of P.109/2017 was rejected by Members.

Part (b), calling for the minimum wage to be set at 60% of median weekly earnings by 2020, was also rejected.

Draft Employment (Minimum Wage) (Amendment No. 14) (Jersey) Regulations 201- (P.104/2017)

Minister for Social Security

Debate Date: 13th December 2017

This proposition tabled the Draft Employment (Minimum Wage) (Amendment No. 14) (Jersey) Regulations 201-, representing the results of the Employment Forum's review of the Minimum Wage. P.104/2017 was adopted and the minimum wage was set at £7.50 from 1st April 2018.

States Employment Board: Living wage 2017 (P.122/2017)

Deputy Southern

Debate Date: 21st February 2018

P.122/2017 proposed that the States of Jersey seek accreditation as a Living Wage employer – ensuring that all States employees were paid the living wage by 1st June 2018. In Jersey, the charitable body "Caritas" has been licensed by the Living Wage Foundation to set the Living Wage rate for Jersey, in consultation with the Foundation, and to promote the adoption of the Living Wage in Jersey[1].

The Council of Ministers provided comments in support of P.122/2017 and noted that accreditation as a Living Wage provider was entirely consistent with the Ministerial aim to promote policies that help people into work, and to earn more at work.

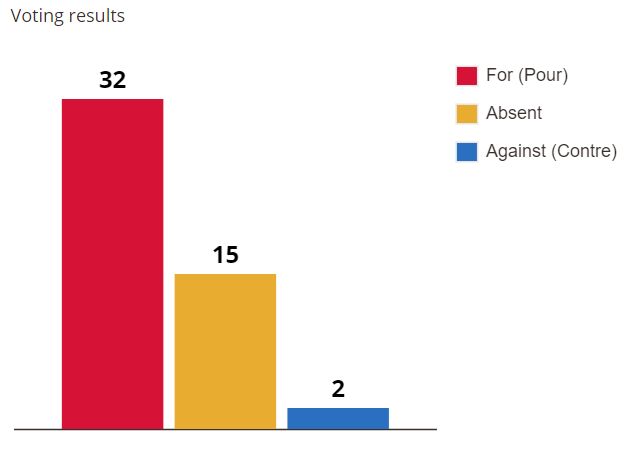

The Proposition was adopted by 42 votes to 1.

Minimum Wage: amendment of States Act dated 21st April 2010 (P.121/2017)

Senator Mézec

Debate Date: 6th March 2018

Within this proposition, the Senator proposed an amendment of the States Act dated 21st April 2010 [2], substituting the words –

"the minimum wage should be set at 45% of average earnings, to be achieved over a period of not less than 5 years and not greater than 15 years from April 2011"

with the words

"the minimum wage should be set at 45% of average earnings by the end of 2020".

The Proposition was made with reference to a statement by the Chief Minister of the time, Senator Ian Gorst, in relation to the Oxera report –

"It is clear that a significantly higher minimum wage could bring both positive and negative consequences, with many employees benefitting and potentially higher consumer spending, but potential job losses and lower incomes for some. Overall, however, this report shows that the States' aspiration to achieve a minimum wage of 45% of earnings by 2026 is too slow. I therefore want to accelerate the timetable, delivering this change by 2020. This will benefit many workers, and support our overall objectives for our economy, population and society. I will be bringing a proposal to the States later in the month to deliver this."

An Amendment and a Second Amendment were submitted by the Council of Ministers. The Second Amendment reinstated the requirement for the Employment Forum to have regard to the decision of the Assembly when making its recommendation to the Minister, which had been inadvertently removed from the original Amendment.

P.121/2017 was adopted, as amended:

THE STATES, […] agreed that the minimum wage should be set at 45% of average earnings by the end of 2020 subject to consideration of economic conditions and the impact on competitiveness and employment of the low paid in Jersey; and requested the Employment Forum to have regard to this objective when making its recommendation on the level of the minimum wage to the Minister for Social Security; and further requested the Council of Ministers to investigate and propose a programme to deliver productivity improvements in low paid sectors, with outline proposals to be delivered in April 2018, and a detailed plan by December 2018.

Draft Employment (Minimum Wage) (Amendment No. 15) (Jersey) Regulations 201- (P.133/2018)

Minister for Social Security

Debate Date: 6th December 2018

The proposition tabled the Draft Employment (Minimum Wage) (Amendment No. 15) (Jersey) Regulations 201-, representing the results of the Employment Forum's review of the Minimum Wage. P.133/2018 was adopted and the minimum wage was set at £7.88 from 1st April 2019 and £8.08 from 1st October 2019.

Draft Employment (Minimum Wage) (Amendment No. 16) (Jersey) Regulations 201- (P.121/2019)

Minister for Social Security

Debate Date: 21st January 2020

The proposition tabled the Draft Employment (Minimum Wage) (Amendment No. 16) (Jersey) Regulations 201-, representing the results of the Employment Forum's review of the Minimum Wage. P.121/2019 was adopted and the minimum wage was set at £8.32 from 1st April 2020.

Employment (Minimum Wage) (Amendment No. 13) (Jersey) Order 2019: rescindment (P.124/2019)

Deputy Ward

Debate Date: 22nd January 2020

The terms of Part (a) of P.124/2019 were similar to those of P.115/2016 Part (a) and P.109/2017 Part (a), requesting the rescindment of the most recent amendment to the Minimum Wage Order. However, P.124/2019 proposed setting the minimum wage at £8.32 from 1st April 2020 – but it also spoke to the implementation of a further increase to the minimum wage, to £8.66 from 1st October 2020.

P.124/2019 built on the commitment of the Assembly, made pursuant to P.121/2017, to ensure that the minimum wage should be set at 45% of average earnings by the end of 2020.

Within its comments the Council of Ministers referred to the most recent publication by the Employment Forum and their commentary upon the level of increase:

The Forum was conscious that a minimum wage equivalent to 45% of mean weekly earnings would require an 8% increase and concluded that "When the aspirational target year of 2020 was agreed by the States in early 2018, the significant economic changes and level of uncertainty for 2020 could not have been predicted. The Forum cannot justify an 8 percent increase in the context of the economic advice and the consultation responses."

Minimum Wage increase and productivity support (P.100/2020)

Deputy Southern

Debate Date: 9th September 2020

Within P.100/2020, Part (a), Deputy Southern requested the Chief Minister, in co-operation with the Minister for Social Security, to take such steps as were necessary to increase the minimum wage to £8.66 per hour from 1st April 2021.

During the debate in relation to P.100/2020 the Solicitor General (the SG) offered legal advice to the Assembly, relating to the ability to prescribe the hourly minimum wage rate as dictated by the Employment (Jersey) Law 2003. He referred to Article 18(1), which places the power with the Minister for Social Security – however the SG explained that, prior to setting a new minimum wage, the Minister must refer to the Employment Forum. He then noted that P.100/2020 appeared to be seeking to compel the Minister to proceed in a certain manner in prescribing the new rate – and therefore the States Assembly would be taking on a power that it did not possess pursuant to the Employment Law. The SG then explained that this could be grounds for a judicial review, along with the potential for review if the Minister did not consult with the Employment Forum.

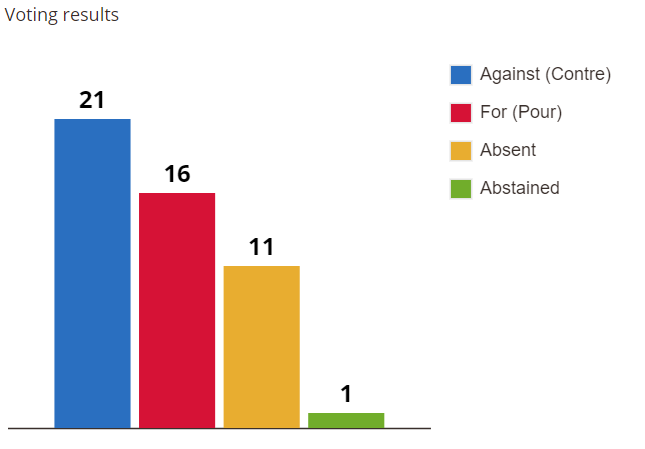

P.100/2020 Part (a) was defeated. However, the vote was closer than previous propositions of this nature.

Within P.100/2020, Part (b), Deputy Southern requested the Minister for Economic Development, Tourism, Sport and Culture to introduce a Productivity Support Scheme for low-pay sectors by 1st April 2021, in line with the programme for Economic Framework and Productivity Support (CSP 3-2-06) set out in 'Government Plan 2020–2023: further information on additional revenue expenditure and capital and major projects expenditure' (R.91/2019).

Part (b) was unanimously agreed.

The funding allocated within the 2020-2023 Government Plan was also present within the more recent 2021-2024 Government Plan. However, the allocation to GP 20-CSP3-2-06 in the 2021-2024 Plan was divided into two categories;

Minimum Wage Increase (P.11/2021)

Deputy Southern

Debate Date: 20th April 2021

The most recent Proposition in relation to the Minimum Wage was P.11/2011. P.11/2011 took into account the advice of the SG in 2020 and requested that the Minister for Social Security, when prescribing the minimum wage or referring matters regarding the minimum wage to the Employment Forum, ensured that any such consideration took into account the view of the Assembly (see below).

Minimum Wage Increase (P.11/2021) was amended by Deputy Southern.

P.11/2021 (Amd) recognised the recent publication by the Minister for Social Security of a consultation document in relation to the Employment Law and the necessity for reference of matters to the Employment Forum. Such consultation also set out questions in relation to the method by which the 2021 and 2022 minimum wage would be set.

After amendment P.11/2021 Part (a) read as follows;

(a) to request the Minister for Social Security to bring forward the necessary legislative amendments to allow for the minimum wage to be prescribed for 2021 and 2022 without a referral to the Employment Forum and to request the Minister to ensure that any prescription of the minimum wage takes into account the view of the Assembly that –

(i) the minimum wage should be set with regard to the median wage;

(ii) from October 2021, the minimum wage should be set at the level of the low-threshold, that is 60% of the median wage; and

(iii) by October 2022, the level of the minimum wage should be lifted to the hourly rate of £10.

The amendment was adopted on a standing vote.

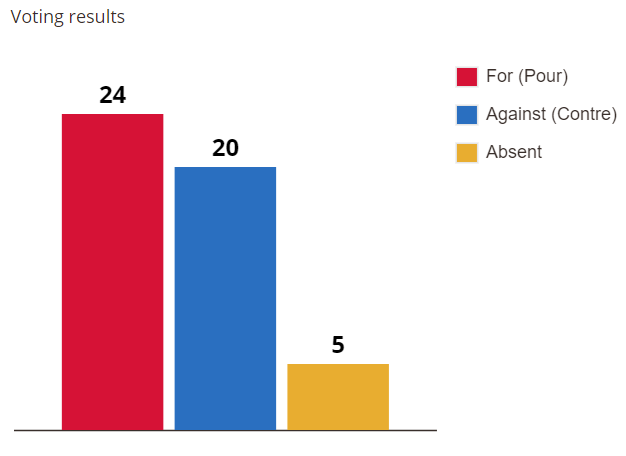

The proposition was taken in parts and all parts of (a) were rejected with votes between 24-25 Against and 20-21 For.

Part (b) of the Proposition which requested the Minister, when appointing members to the Employment Forum, to appoint at least 2 members who were representatives of third sector organisations with an interest in the alleviation of poverty, was also rejected.

The final vote requested the Minister to refer to the Employment Forum the potential for the minimum wage to be set at a level of the Jersey Living Wage. This article was adopted.

Review of the Minimum Wage in Jersey: Process and Rate – Consultation Exercise (R.62/2021)

Minister for Social Security

The Social Security Minister decided to review the way in which the Jersey minimum wage was set. The current process had been in place for 15 years. The Minister decided to review the current system and to look at possible alternatives for Jersey and invited contributions to a consultation exercise. The consultation also considered how the next minimum wage rate should be set.

R.62/2021 noted that the Covid-19 pandemic prevented the usual minimum wage review in 2020. The minimum wage remained at £8.32 per hour and was not to be increased in April 2021. The consultation was therefore also to consider when the minimum wage should next be increased and how that increase should be set.

The consultation ran from 16th April 2021 to 31st May 2021.

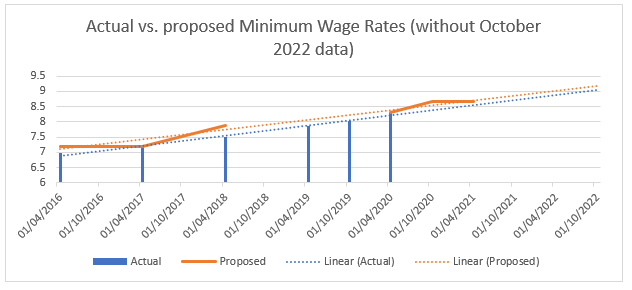

Appendix A

Actual vs. proposed Minimum Wage rates

*To bring the Minimum Wage up to this figure over the intervening period

Minimum

wage (per hour)

| £7.88

| £8.02 | £8.32 |

|---|

Trainee rate year 1 (per hour)

| £5.91

| £6.02

| £6.24 |

|---|

Trainee

rate year 2 (per hour)

| £6.90

| £7.02

| £7.28

|

|---|

Maximum

weekly offset against minimum wage for accommodation and food

| £86.23

| £87.78

| £91.12

|

|---|

Maximum

weekly offset against minimum wage for accommodation and food

| £114.94

| £117.01

| £121.46

|

|---|

Maximum

weekly offset against trainee rates for accommodation

| £64.67

| £65.84 | £68.34 |

|---|

Maximum

weekly offset against trainee rate for accommodation and food

| £86.21

| £87.76

| £91.10 |

|---|

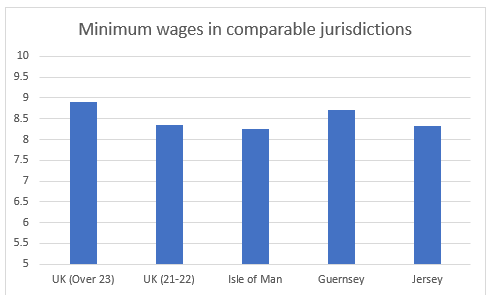

Appendix B

Minimum wages in comparable jurisdictions

Jersey

| £8.32 | 1st April 2020

|

Guernsey

| £8.70 £8.50 | 1st January 2021 1st January 2020

|

Isle of Man

| £8.25 | 1st October 2019 |

UK (Over 23)

| £8.91

| 1st April 2021 (Living Wage)

|

UK (21-22)

| £8.36

| 1st April 2021

|

UK (18-20)

| £6.56

| 1st April 2021

|

[1] The Jersey Living Wage Rate, set by the Jersey Living Wage Advisory Committee which assists Caritas, is £10.96 p/h for 2021

[2] The reference here to an Act is not to an item of legislation but simply to a decision by the Assembly